Maximize Your Savings with a Roth IRA Calculator: Simple Steps to Grow Your Money

Roth IRA calculator is a great tool to help you plan your money for the future. If you want to save for retirement, using a Roth IRA calculator can show you how much money you can have later. It works by looking at how much you put in, how long you save, and the interest your money can earn. Many people are unsure how much to save or when they can reach their goals. This calculator makes it simple. You don’t need to be a finance expert to use it. By entering small amounts every month, a Roth IRA calculator can show how even little money can grow big over time. It can help you plan smartly and make sure your retirement is safe and comfortable.

Using a Roth IRA calculator also teaches you about different choices for your money. You can see how changing your monthly savings or the age you start saving can make a big difference. It can also help you compare different investment options and see which one grows faster. Many people worry that they start too late or cannot save enough, but a Roth IRA calculator shows real numbers that make planning easy. By using it regularly, you can track your progress and make small changes to reach your goals faster. It is like having a map for your future money. You can plan how much to save each month, see how taxes affect your earnings, and feel more confident about retirement. A Roth IRA calculator is a simple way to make smart money decisions, even if you are new to investing.

How a Roth IRA Calculator Helps You Plan Your Future

A Roth IRA calculator is more than just numbers on a screen. It helps you understand how your money grows over time. By entering your age, current savings, monthly contributions, and expected interest rate, you can see how much you might have when you retire. Many people think they need to save a lot to retire comfortably, but this tool shows that even small amounts can grow if you start early.

Planning your future can be stressful, but a Roth IRA calculator makes it easier. You can experiment with different savings amounts and see how they change your results. It also helps you understand the power of compounding interest. The longer your money stays invested, the more it grows. A Roth IRA calculator gives you real, easy-to-understand numbers so you can plan without guessing.

Step-by-Step Guide to Using a Roth IRA Calculator

Using a Roth IRA calculator is simple and does not require financial knowledge. First, enter your current age and the age you want to retire. Next, add your current savings and how much money you plan to contribute each month or year. Finally, choose an estimated annual return or interest rate. The calculator will show your estimated balance at retirement.

It is important to update your inputs regularly. Life changes, income changes, and market conditions can affect your savings. By adjusting numbers, you can see how small changes impact your retirement fund. This step-by-step use ensures you always have a clear view of your future and helps you make smart decisions.

Why Starting Early with a Roth IRA Calculator Makes a Big Difference

Time is a very powerful factor in saving for retirement. A Roth IRA calculator can show you how starting early gives your money more time to grow. Even if you start with a small amount, compounding interest over years can make your savings much bigger.

Many people delay saving because they think they are too young or don’t have enough money. Using a Roth IRA calculator shows that every dollar counts. Starting early reduces stress later and helps you build a larger retirement fund. This calculator encourages people to save consistently and make better financial decisions.

How Monthly Contributions Affect Your Roth IRA Calculator Results

Monthly contributions are the building blocks of your retirement savings. A Roth IRA calculator helps you see the effect of different contribution amounts. Saving a little extra each month can have a huge impact over decades.

For example, adding just $50 more every month may not seem like much, but over 20 or 30 years, it can grow significantly. By using the calculator, you can plan your contributions according to your income and goals. It also motivates you to stay consistent with your savings habits.

Understanding Growth and Interest in a Roth IRA Calculator

Growth and interest are key to how your Roth IRA grows. The calculator uses an estimated annual return to show how much your money can increase each year. This is called compounding, and it can turn small contributions into large savings over time.

It is important to remember that returns may vary depending on the investments you choose. A Roth IRA calculator gives an estimate, not a guarantee. Still, it helps you understand the potential growth and plan accordingly. Seeing these numbers makes saving less confusing and more motivating.

Comparing Investment Options with a Roth IRA Calculator

A Roth IRA can include stocks, bonds, mutual funds, and other investments. Each has a different potential return and risk. A Roth IRA calculator lets you try different scenarios to see which options could grow your money faster.

By comparing options, you can make better choices for your savings. The calculator helps you balance risk and growth, depending on your comfort level. Even beginners can use it to see how different investments affect their retirement balance.

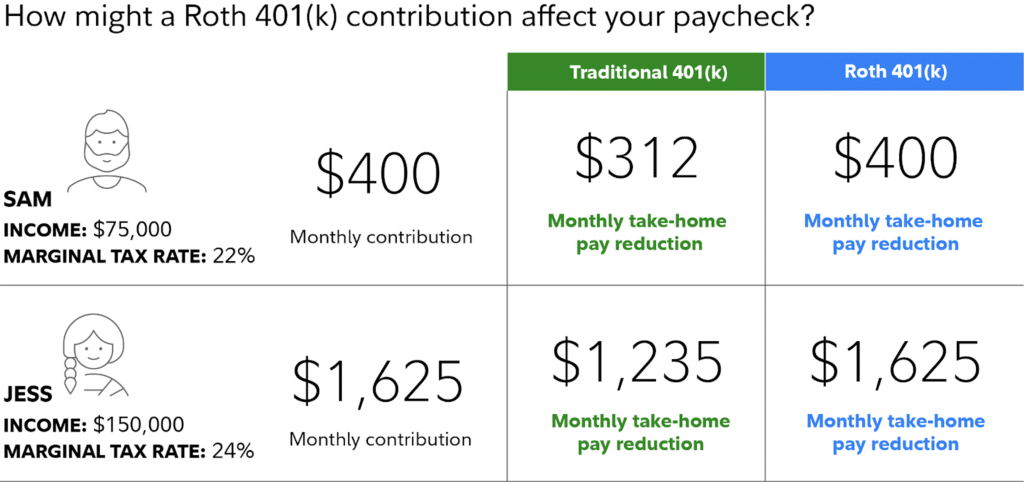

How Taxes Work in Your Roth IRA Calculator Calculations

One big benefit of a Roth IRA is tax-free growth. Unlike other retirement accounts, the money you withdraw during retirement is generally tax-free if rules are followed. A Roth IRA calculator can show you how much you might save in taxes over time.

Understanding taxes helps you plan smarter. You can see how contributions today affect your future withdrawals and avoid surprises. Using the calculator regularly gives you a clear picture of your money, growth, and tax advantages.

Adjusting Your Savings Goals Using a Roth IRA Calculator

Life is always changing. Your income, expenses, and financial goals may change too. A Roth IRA calculator allows you to adjust your goals anytime. You can increase or decrease contributions, change retirement age, or try different growth rates to see the impact.

This flexibility is important because it keeps your retirement plan realistic. You don’t have to guess about your future. The calculator gives numbers you can trust and helps you make adjustments without stress.

Common Mistakes to Avoid When Using a Roth IRA Calculator

Even with a calculator, mistakes can happen. Common mistakes include:

- Using too high or too low interest rates

- Forgetting to update contributions

- Ignoring inflation

- Not planning for unexpected expenses

A Roth IRA calculator is a helpful tool, but it works best when used carefully and with accurate numbers. Regular updates and realistic assumptions make your planning more effective.

How a Roth IRA Calculator Can Improve Your Retirement Planning

Using a Roth IRA calculator regularly improves your financial confidence. You can see exactly how your money grows, what adjustments help, and how to reach your goals faster. It removes uncertainty and replaces it with clear numbers.

The calculator also motivates consistent saving. Watching your balance grow over time encourages you to keep saving, even when life gets busy. With this tool, retirement planning becomes less scary and more achievable.

Using a Roth IRA Calculator for Young Adults and Beginners

Even if you are young or new to investing, a Roth IRA calculator is easy to use. You don’t need complicated knowledge about stocks or finance. Enter simple numbers and watch how your savings grow.

Starting early gives you more time for compounding and higher balances at retirement. The calculator teaches good saving habits and shows how small, consistent efforts can lead to big results.

Tracking Progress and Updating Your Roth IRA Calculator Regularly

Your retirement plan is not one-time work. Life changes, and so should your plan. Using a Roth IRA calculator regularly helps you track progress and adjust contributions or retirement age.

By updating numbers, you stay on track for your goals. This makes your planning realistic, flexible, and stress-free. You always know where you stand and what you need to do next.

Conclusion

A Roth IRA calculator is a simple but powerful tool to help you plan your retirement. It shows how contributions, growth, and time affect your savings. By using it, you can make smart choices, avoid mistakes, and stay on track to reach your goals. Whether you are young or close to retirement, this calculator can guide you every step of the way. Saving consistently, starting early, and tracking progress with a Roth IRA calculator can make your retirement dreams a reality.

FAQs

1. What is a Roth IRA calculator?

A Roth IRA calculator is an online tool that estimates your retirement savings based on your contributions, age, and expected growth.

2. How much should I contribute each month?

It depends on your goals and income. A Roth IRA calculator can help you find the right amount.

3. Can I use it if I am new to investing?

Yes, it is simple and designed for beginners too.

4. Does it guarantee returns?

No, it gives estimates based on assumptions. Actual results may vary.

5. How often should I update my calculator?

It is best to update it whenever your income, contributions, or goals change.