Key Takeaways

- Invoice finance unlocks working capital, enabling businesses to grow and expand more quickly.

- This alternative funding method is flexible, scalable, and doesn’t contribute to long-term debt.

- Effective use of invoice finance enables businesses to expand into new markets, hire staff, and invest in essential resources.

Understanding Invoice Finance

For many growing businesses, cash flow challenges are a common obstacle. Invoice finance offers a valuable solution, enabling companies to release the funds locked in unpaid invoices. This process involves selling pending invoices to a finance provider, granting the company nearly instant access to money that would otherwise be tied up until the customer pays. Among the available options, invoice discounting for businesses offers a discreet way to access funds while maintaining control over customer payments and preserving existing relationships.

The flexibility of invoice finance makes it appealing to businesses of all sizes and across numerous industries. Rather than waiting weeks or months for customers to settle outstanding bills, organizations can use these funds to pay suppliers, cover payroll, or reinvest in growth-driving opportunities as soon as the invoice is issued. This timely access to funds alleviates cash flow constraints, reduces the stress associated with late payments, and ensures smooth daily operations.

Unlike traditional loans, which require fixed repayments and create additional debt on the balance sheet, invoice finance is directly linked to your sales cycle. This means that as your business grows, so does your available funding—without the risk of overextending yourself with new liabilities. In an era where access to agile financing is a key competitive advantage, invoice finance offers a lifeline to business owners working to expand.

Benefits of Invoice Finance for Business Growth

- Enhanced Cash Flow: With immediate cash at your disposal, you’re better equipped to cover operational expenses, invest in inventory, or take advantage of growth opportunities at short notice.

- Flexibility and Scalability: The volume of funding is tied to your sales, so as your business wins new contracts or expands its customer base, your capacity to access finance also grows.

- No Additional Debt: Unlike loans, invoice finance doesn’t add to the company’s long-term liabilities—enabling a healthier balance sheet, which can be important when pursuing further investment or credit.

These advantages are particularly vital when navigating periods of rapid expansion, unpredictable demand, or seasonal fluctuations. By smoothing out cash flow, invoice finance minimizes the risk of missed opportunities due to a lack of liquidity and supports confident, future-forward business planning.

How Invoice Finance Supports Expansion

Having ready access to working capital through invoice finance empowers companies to pursue expansion strategies proactively. Some of the most common uses of invoice finance in business growth include:

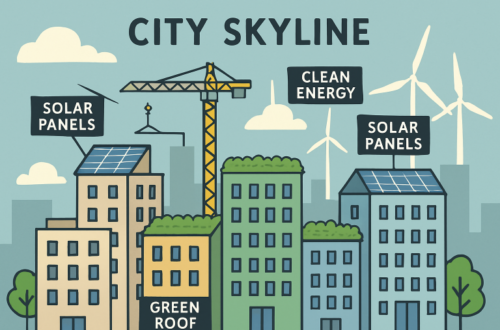

- Investing in New Equipment:Businesses can purchase additional machinery, upgrade technology, or enhance their infrastructure to boost productivity and meet growing demand.

- Hiring Additional Staff: Enhanced cash flow removes the financial barriers to taking on new employees, enabling businesses to scale their workforce and efficiently fulfill large orders or new contracts.

- Entering New Markets: From marketing campaigns to regional set-up costs, invoice finance provides the liquidity necessary to break into new markets or diversify product offerings.

These expansion activities are often time-sensitive. Fast access to funds ensures that opportunities can be seized when they arise, instead of missing out while waiting for customer payments. The ability to act quickly on market opportunities is a key reason why dynamic businesses favor invoice finance, particularly those with ambitious growth plans. According to NetSuite, businesses that leverage invoice finance often outperform their peers when scaling up operations.

Real-World Applications

Across various industries, invoice finance has proven its value as a facilitator of growth. For example, a manufacturing company aiming to fulfill a large order used invoice finance to buy raw materials in bulk, allowing it to negotiate better rates with suppliers—boosting margins and net profit. In another case, a professional services provider utilized invoice finance to rapidly expand its workforce, ensuring it could handle a surge in client projects without compromising service quality.

Retailers and wholesalers have also benefited from utilizing invoice finance to launch new product lines or support overseas expansion, thereby overcoming the lengthy payment terms common in B2B commerce. By converting accounts receivable into actionable capital, these businesses are overcoming the limitations that typically hinder fast-paced growth.

Choosing the Right Invoice Finance Provider

Selecting a suitable invoice finance provider can significantly impact the success of your funding strategy. Key factors to consider include:

- Reputation: Look for providers with a strong track record, positive client testimonials, and industry recognition. Reviews and case studies can provide valuable insights into their reliability and client service.

- Terms and Fees: Carefully review contract terms and fee structures. Transparent pricing with no hidden charges is essential to ensuring alignment with your budget and financial objectives.

- Solution Flexibility: A good provider will offer tailored solutions to fit your unique needs, whether you require selective invoice discounting, full ledger financing, or sector-specific support.

It’s also essential to select a provider that understands your sector and can provide informed guidance on navigating seasonal trends or industry-specific payment practices.

Final Thoughts

Invoice finance stands out as a powerful strategy for businesses aspiring to expand efficiently and sustainably. By unlocking the cash otherwise tied up in receivables, companies gain the means to fund critical growth initiatives, whether that’s entering new markets, hiring additional staff, or scaling production. In a landscape where fast, flexible funding is increasingly linked to competitive success, invoice finance provides the agility and confidence that growing businesses need to thrive.